Kick-start your investment property portfolio with confidence

We are investment specialist mortgage brokers, which means…

We specialise in sourcing appropriate investment loans for buyers seeking to purchase an investment property. We act on your behalf to find the best investment loan(s), in consideration of your long-term portfolio goals and required lending structures.

Increase your borrowing Capacity

Navigate Lender’s Investment Policies

Efficiently Structure Investment Debt

- Help you grow your portfolio – with more choices to meet your specific needs

- Secure loan approvals – even if banks have turned you down or are limiting your borrowing capacity

- Specialise in structuring investment portfolios – you get a solution that’s right for you – not the one ‘one-size-fits-all default plan’ so many companies offer

- Access the lowest investment rates available

- Provide step-by-step support from a dedicated investment lending strategist

How much does it cost to use a Mortgage Broker?

Our services are completely free for all home and investment loans. We get paid by the lenders for doing the work, collating your loan application and meeting with you. This work would otherwise be done by a bank manager or branch lender so you get access to the same rates as if you went to the lender directly.

The benefit for you is that unlike when dealing with one bank, we can help you work with a wider variety of lenders and get the best options that work for you choosing from our panel of over 50 banks and lenders!

Why engage a specialist investment mortgage broker to help me find the right investment loan?

- Capacity (or borrowing power)

- Policy (which can impact approvals and borrowing capacity)

- Lending structure (which can constrain future borrowing efforts)

- Entity (which can complicate your lending applications)

How can lending policies can restrict your investment borrowing capacity?

From a lenders point of view, investors who borrow more are considered to be higher value clients. However, investment loans are also typically considered a higher risk to a lender.

Consider an event where the bank had to sell an investment property to recover their debt, they may have problems with tenants refusing to move out or potentially destroying the property. It is for these, and other reasons that banks tend to have stricter lending guidelines for investment!

Therefore, it is important to find a bank that encourages investors, not one that has a conservative view of investment loans.

When it comes to assessing the borrowing capacities for our investment clients, these are some of the immediate capacity restrictions we seek to address…

Most banks use only 80% of your rental income in their assessment but some use 100%.

All banks assess your base salary in the same way, but they differ in the way that they assess overtime, bonuses, commission, allowances, trust distributions, dividends, and self-employed income.

Most banks don’t calculate your borrowing capacity using the actual rate that you are paying. They add up to 2% to the current rate to make sure you can afford the loan if the rate were to increase. Some lenders do not load the rate when assessing your loan or use the actual rate if it is fixed for more than 3 years!

- Net Disposable Income (NDI): This method is used to assess your ability to meet regular fixed financial commitments.

- Debt Service Ratio (DSR): This method calculates the percentage of a customer’s gross income that is used to service a debt.

Some banks assess the repayments on your existing debts using principal and interest repayments, even if you are paying interest only! This is a major problem for investors with larger portfolios because often they cannot afford principal and interest (P&I) repayments on all their debts.

Before, lenders were lending as high as 90% or even 95% loan-to-value ratio (LVR). Now some lenders have reduced that down to as low as 70% which limits many property investors in terms of being able to fund the deposit for a new investment purchase.

Did you know that not every lender takes negative gearing benefits into account? If your portfolio is not positively geared, then find a lender who can include these benefits in a serviceability calculation.

Banks and lenders all have different lending thresholds, which is the amount of borrowing they are happy to lend to an individual, couple, or entity. Many are reluctant to lend past $1.5 million, and very few banks or lenders will openly disclose this.

If you own multiple investment properties, often we will recommend a multi-lender strategy. This means refinancing your existing loans with the cheapest lender possible, then applying to buy new properties with the lender that allows you to borrow the most. This approach gets you the amount you need without paying so much interest.

Efficient Loan Structuring

Another important consideration, which is less impactful to your immediate lending requirements, but can create longer-term issues when you decide to scale your investment portfolio is loan structuring.

When building your property portfolio, your focus should be on retaining maximum control over your assets – which is difficult to maintain if your loans are cross-collateralised.

Cross-collateralisation explained

Collateral is defined as ‘security used for the payment of a loan’ and to cross-collateralise is to use multiple securities for the payment of a loan or loans.

How can inefficient loan structuring impact your future investment opportunities and long-term flexibility?

If a property portfolio is cross collateralised it can limit the way in which sale proceeds may be used.

For example, if a property is sold, the bank may require your sale proceeds be used to reduce other loans in your portfolio, to keep the Loan to Valuation Ratio (LVR) within a certain level.

In this case, the loan proceeds would not be able to be used at the investor’s discretion.

It is often the case that every property in a cross-collateralised portfolio needs to be re-valued whenever one property is released.

There may be significant costs associated with valuing each property, especially if the portfolio is not within a loan package product.

The valuations are undertaken for the bank to determine its exposure with the remaining properties and if the market timing is not ideal, you may find the outcome of your property valuations result in an increase in overall LVR or reduction in borrowing capacity.

In addition, there is documentation to be executed every time a portfolio is changed. This paperwork is known as a Variation of Security.

In general, most property investors favour Interest Only loans.

As an investor’s exposure increases with any one lender, that lender can restrict future loans to Principal and Interest only.

Regardless of one’s asset position, many banks will want to control the type of loan that they will make available to an investor when his or her aggregate debt with them is high.

It can often be a better strategy for an investor to use a multiple lender strategy, therefore gaining access to the most suitable loan products within the different lenders borrowing thresholds.

When a loan(s) is secured by multiple properties, the establishment fees are usually higher as they include charges for ‘additional’ security.

This cost can be compounded when an investor wishes to move those cross-collateralized properties from one lender to another.

Exit fees can compound and be significant if any of the loans are fixed.

In addition, new valuations may be required (as explained above) where the investor wishes to release a property.

If one property in the portfolio has enjoyed a capital gain and the others have dropped in value, the net effect on the total value may be zero.

The equity in the property that increased in value is inaccessible to the investor because overall the equity in the portfolio has not increase.

The consequences of this outcome could mean that an investor does not have ready access to cash and may miss valuable investment opportunities.

If the loans were not cross-collateralized, an application to increase the loan or credit limit against the property that increased in value would be a relatively simple process.

Warning: Many property investors believe that their home loans are stand-alone when in fact they are crossed-collateralised with other properties. What do we mean by this?

The need for borrowers to cross-collateralise their property assets is often unnecessary, it is generally the default structure proposed by your lender which provides them with the benefit of greater control over your property assets. For a borrower cross-collateralisation provides no benefit, with the strategy having the ability to negatively impacting your future investing opportunities.

Case Study: How the banks hold more security than necessary

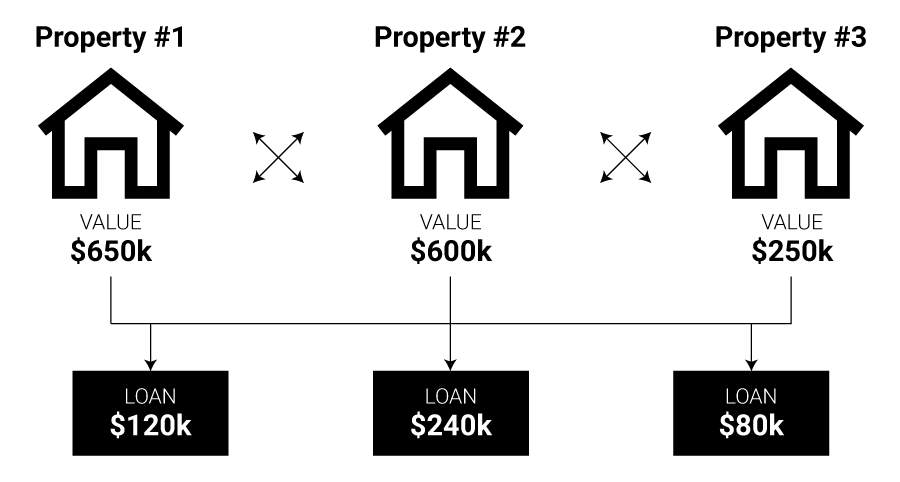

Let’s say all your banking is with XYZ Bank and over the last 8 years you have accumulated three properties.

[Property #1] Your home is worth $650,000 with a loan balance of $120,000 owing

[Property #2] Your first investment property is worth $600,000 with a loan balance of $240,000 owing and is secured against your home.

[Property #3] Your second investment property is worth $250,000 with a loan balance of $80,000 owing and is secured against your home and your first investment property.

Total value of your property assets = $650,000 + $600,000 + $250,000 = $1,500,000

Total value of your liabilities = $120,000 + $240,000 + $80,000 = $440,000

The overall Loan to Value Ratio (LVR) > $440,000 / $1,500,000 = 29.33% LVR

In the case study above, you can see XYZ bank holds $1,500,000 of assets against only $440,000 worth of loans which is a 29.33% loan to value ratio. In this case study XYZ bank holds far more security than necessary, especially considering lenders are happy to have a funding ratio as high as 80% before LMI fees are incurred.

What does the right investment structure look like?

It is important to note, that cross-collateralisation of loan securities is not a problem until it becomes a problem – and your first line of defence is avoiding crossed loan structures to begin with.

How to structure your investment lending without cross-collateralising

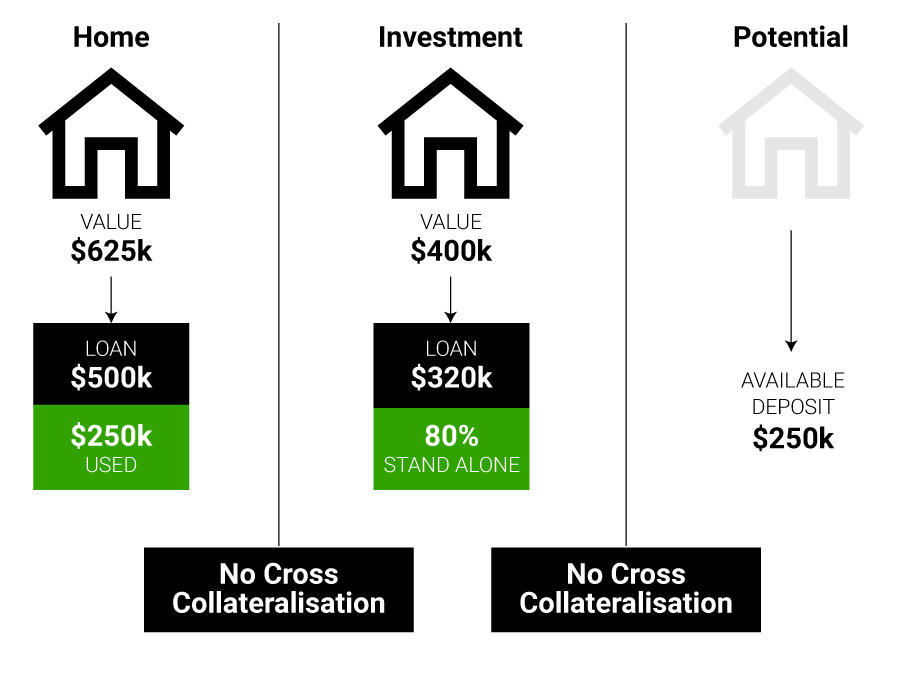

Andrew has a home worth $625,000 that he owes $150,000 and is about to purchase an investment property worth $400,000.

Step 1: Andrew finances his home with an Interest Only Variable Split* up to $350,000 (or 80% of his homes value) as a stand-alone loan.

*As this facility will be Interest Only, repayments will only commence once funds are withdrawn.

Step 2: When Andrew has sourced his investment property, he takes the deposit and closing costs from his Interest Only Variable Split to contribute to the purchase of his investment property. This is usually 20% deposit plus approx. 5% for closing costs, so that’s $100,000.

Step 3: Andrew then finances the balance of his investment property purchase with a 5yr Interest Only Loan^ for $320,000 (or 80% of the investment properties value) secured against his investment property purchase.

^Investors generally prefer interest only loans while there is current borrowing held against non-deductible assets.

Here is how Andrew’s lending would look…

Benefits of structuring your investment lending this way…

The approach detailed above benefits Andrew the property investor in the following ways:

- He is not limited to his current lender – Andrew could source an investment loan for the balance of his investment property purchase from any lender that would offer him preferential lending terms.

- He has increased his tax deductibility – As $100,000 from his Interest Only Variable Split and $320,000 from his new investment lending have been used to purchase his $400,000 investment property, which is a deductable asset, Andrew will be able to use the interest payable on $420,000 as a tax deduction.

- He has preserved his deposit power – As Andrew still has $250,000 in his Interest Only Variable Split that is secured against his home that he is able to deploy for the purchase of additional property investment in the future.

- He has retained greater control over his assets – As neither of Andrews property assets are cross-collateralised, Andrew is free to sell, re-value, draw equity (if equity is available) or refinance either property without being impacted by the current performance of the other property.

While the above example is based on two properties, as property portfolios grow, accessing equity or having the flexibility to move certain loans to lenders with more preferential lending terms can have a big impact on your ability to grow your portfolio.

Important to know:

When assessing lenders, we want to know whether the lenders we are considering will allow stand-alone loans with stand-alone security. Most banks do but it is important you insist on it.

When applying for a loan it is important your application stipulates that you do not want your investment properties cross-collateralised otherwise a lender will automatically do it. This is something we stipulate every time and still on occasion we have to send documents back for reprinting.

Why use an investment specialists mortgage broker when you can get a loan through your bank?

Get a loan with Next Home Loans

- We take extra time up front to go through your full situation and provide a complete lending solution.

- Our brokers will look at your needs now and into the future, to make sure you have the best possible loan that looks after all of your needs.

- A mortgage broker acts on your behalf to arrange a home loan through a bank or lender. Australian banks and lenders have different policies and loan requirements, and it is a brokers job to find a loan from one of these parties that fit with your individual situation.

Dealing directly with a lender

- Many banks have a "quantity over quality" policy, meaning that they care more about adding to their quota than about your financial future.

- Lenders can only offer you a limited selection of loan products. There's no guarantee that you're getting the best deal available.

- Due to the complexity of mortgage applications, sometimes even the bank staff don't know their bank's policies! This can lead to delays in your loan application, and in some instances your loan will get declined for no good reason.

Additional reasons our clients prefer to use an investment specialist mortgage broker

- How much can I borrow?

- Should I choose a fixed or variable loan?

- How long will it take to get approval?

- How can I strengthen my application?

- What should I look out for?

It is important to note: The answers to these questions can vary widely between lenders!

When you work with Next Home Loans, you work one-on-one with an Investment Specialist who’s number one priority is to help you clarify and achieve your goals.

For most of our clients this means getting approved for an investment loan with the lowest possible rate to keep repayments low, and an optimal structure to ensure future opportunities remain accessible.

We will work with you personally and take the time you need. We’ll never talk down to you or make you feel like a ‘fish out of water’. You’ll be in good hands and together we’ll make your home-ownership dream, a reality.